How it Works

Three Simple Steps to R&D Compliance

From using AI to improve youur plan to automating

your transaction reconcilliation, Avanzu streamlines

the entire R&D Tax Incentive process.

1. Plan Your R&D Activities with AI

Use AI to define your core and supporting R&D activities for the tax year. Set budgets, add descriptions and evidence that meet AusIndustry requirements.

2. Allocate Transactions Automatically

Connect to Xero once and watch transactions flow in. Allocate costs to R&D activities with simple percentage-based rules—just like Xero reconciliation.

3. Track Your Rebate in Real-Time

See your estimated R&D tax incentive rebate update instantly as you allocate. Export compliant reports for your accountant or AusIndustry submission.

Essential Features

Designed for Australian R&D Compliance

Built from the ground up to simplify the R&D Tax Incentive process

for startups and SMEs across Australia.

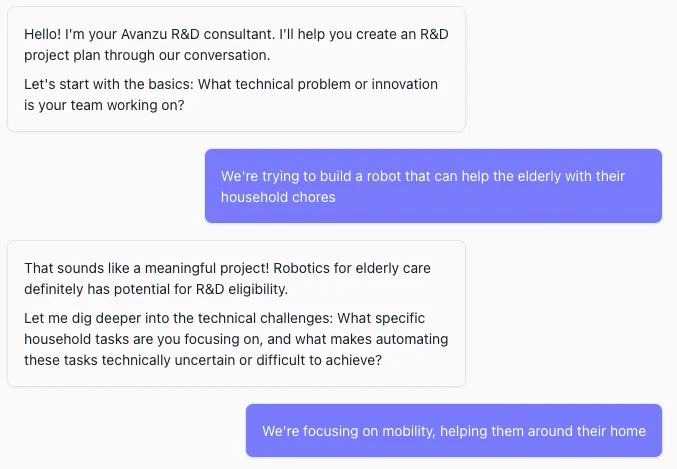

AI-Powered R&D Assistance

Our intelligent chatbot helps you create comprehensive R&D plans from scratch or enhance existing plans for better compliance. Get instant guidance on activity descriptions, budgets, and AusIndustry requirements.

Write New R&D Plans

Start from scratch with AI-guided planning. Build comprehensive R&D activity descriptions and budgets that meet compliance standards.

Enhance Existing Plans

Improve your current R&D documentation with AI suggestions to ensure it meets all AusIndustry requirements and compliance standards.

Seamless Xero Integration

Connect your Xero account once and automatically sync transactions. Allocate costs to R&D activities with a simple, familiar interface—just like Xero reconciliation.

-

Pull transactions from Xero automatically and set allocation rules to save time.

-

Create rules to automatically allocate transactions based on accounts, employees, or assets.

-

Track spending against your core and supporting R&D activities with real-time rebate calculations.

Key Features

Everything You Need for R&D Tax Compliance

Purpose-built tools that simplify R&D planning, transaction tracking,

and rebate calculations for Australian businesses.

AI-Powered R&D Planning

Write comprehensive R&D plans from scratch with our intelligent chatbot assistant, or enhance existing plans to ensure full compliance. Get expert guidance on activity descriptions, budgets, and AusIndustry requirements—all in real-time.

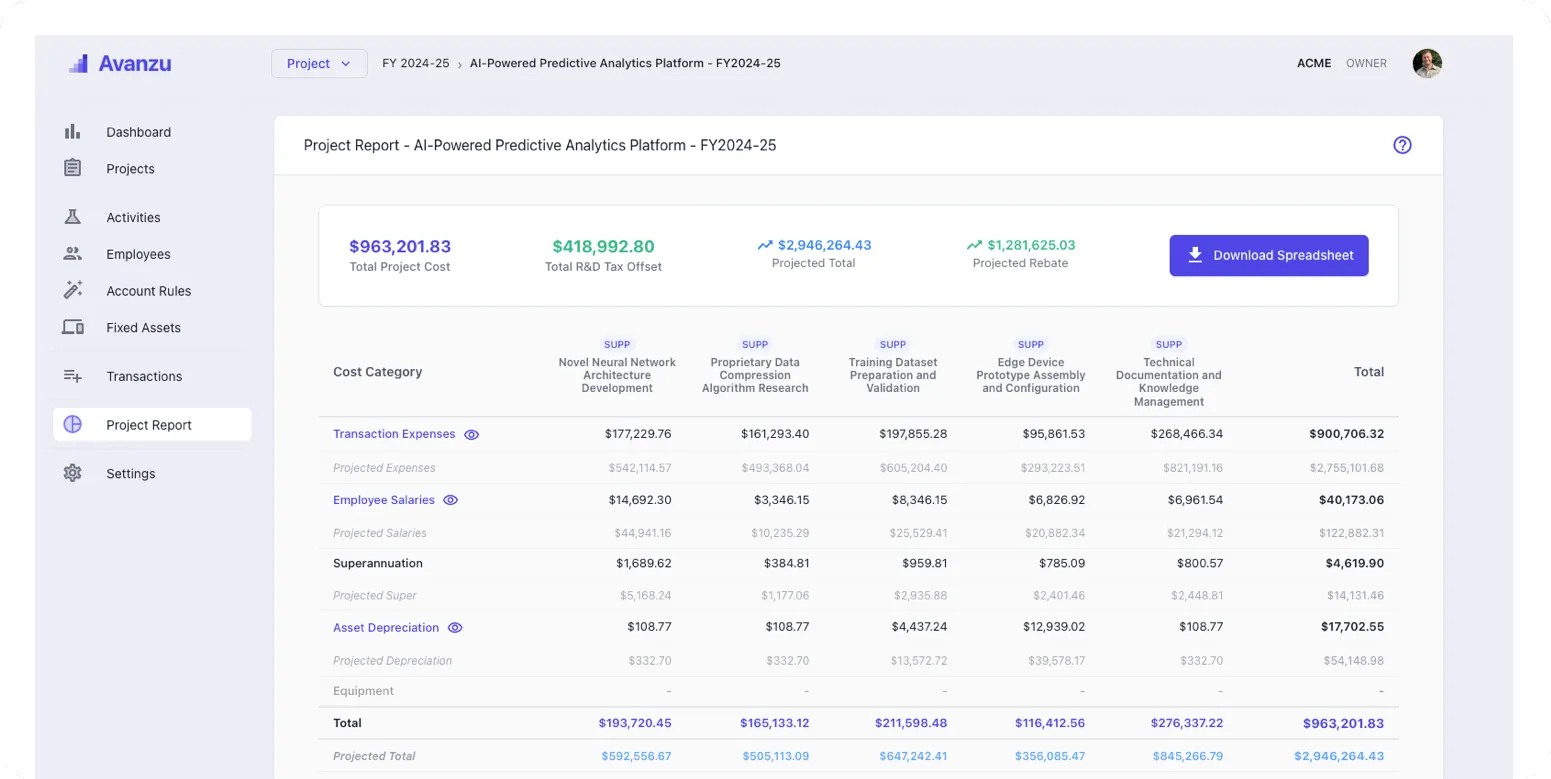

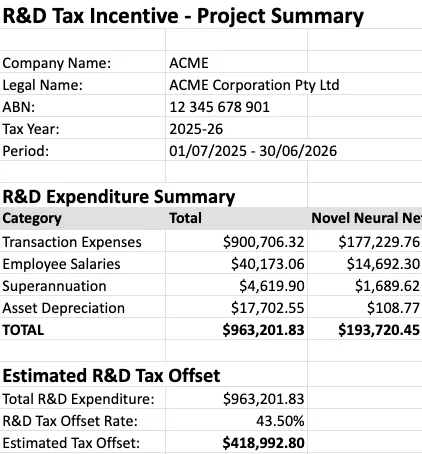

Comprehensive Excel Export

Automatically generate detailed Excel spreadsheets containing your full RDTI accounts and plan. Perfect for future audits, sharing with your accountant, or integrating into your existing accounting workflows.

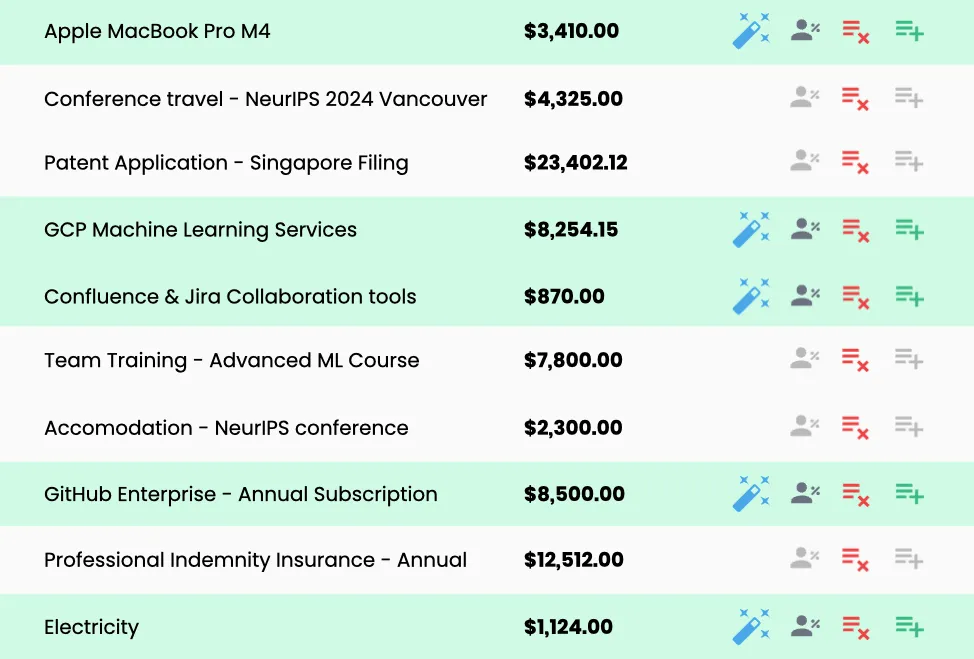

Automatically allocate transactions

Automatically allocate transactions to activities based on account rules, automate and speed up the most annoying part of R&D account compliance.

Get Started Details

How It Works

Your R&D Dashboard at a Glance

Create AI-powered R&D plans, track activities, monitor spending, and see

your estimated rebate update in real-time as you allocate transactions.

AI Planning Assistant

Access our intelligent chatbot to write comprehensive R&D plans from scratch or enhance existing plans with compliance-focused suggestions and guidance.

Activity Progress Tracking

Visual indicators show how much you've spent against budget for each core and supporting R&D activity throughout the tax year.

Transaction Allocation Status

See at-a-glance which transactions have been allocated to R&D activities and which still need attention, just like Xero's reconciliation view.

Rebate Calculator

Real-time calculation of your estimated R&D tax incentive rebate based on your current allocations and activity spending.

Compliance Checklist

Track your progress towards AusIndustry submission requirements with activity documentation and budget allocation status.

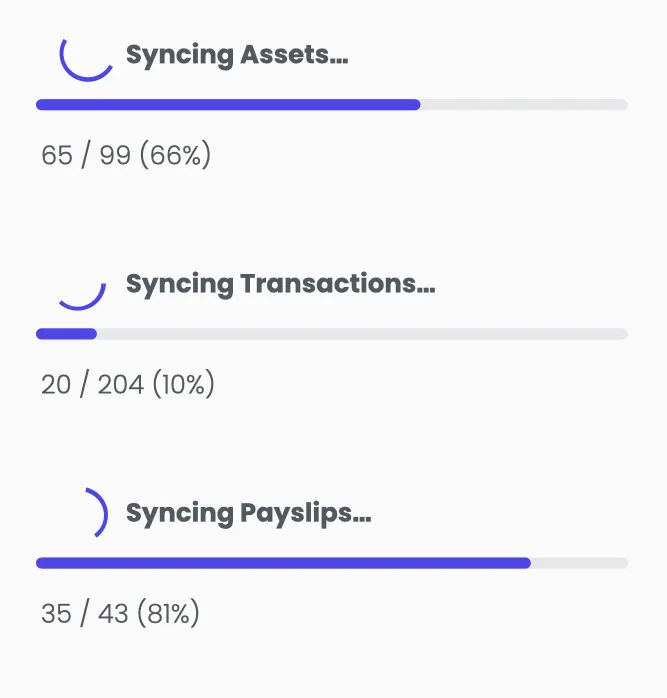

Xero Sync Status

Monitor your connection status and see when new transactions were last synced from your Xero account.

Simple Pricing

Choose the plan that fits your business

Flexible monthly subscriptions to manage your R&D tax incentive claims.

Scale as you grow with plans designed for startups to enterprise. All our plans come with Full Xero Integration, Core & Supporting Activity Management, Real-time Rebate Calculations and Excel report generation

Startup

Perfect for startups and small businesses.

- 1 Project per year

- 1,000 Project transactions

- 10 Users

- AI Planning Tools

Scaleup

For larger businesses with 1000's of annual transactions.

- 1 Project per year

- 2,500 Project transactions

- 25 Users

- AI Planning Tools

Unicorn

For larger companies running multiple research and development projects.

- Unlimited Projects per year

- Unlimited Project transactions

- Unlimited Users

- AI Planning Tools

Stop Losing R&D Tax Credits at Year End

Join Australian startups saving hours of compliance work with automated transaction tracking and real-time rebate calculations.

Start Free Trial